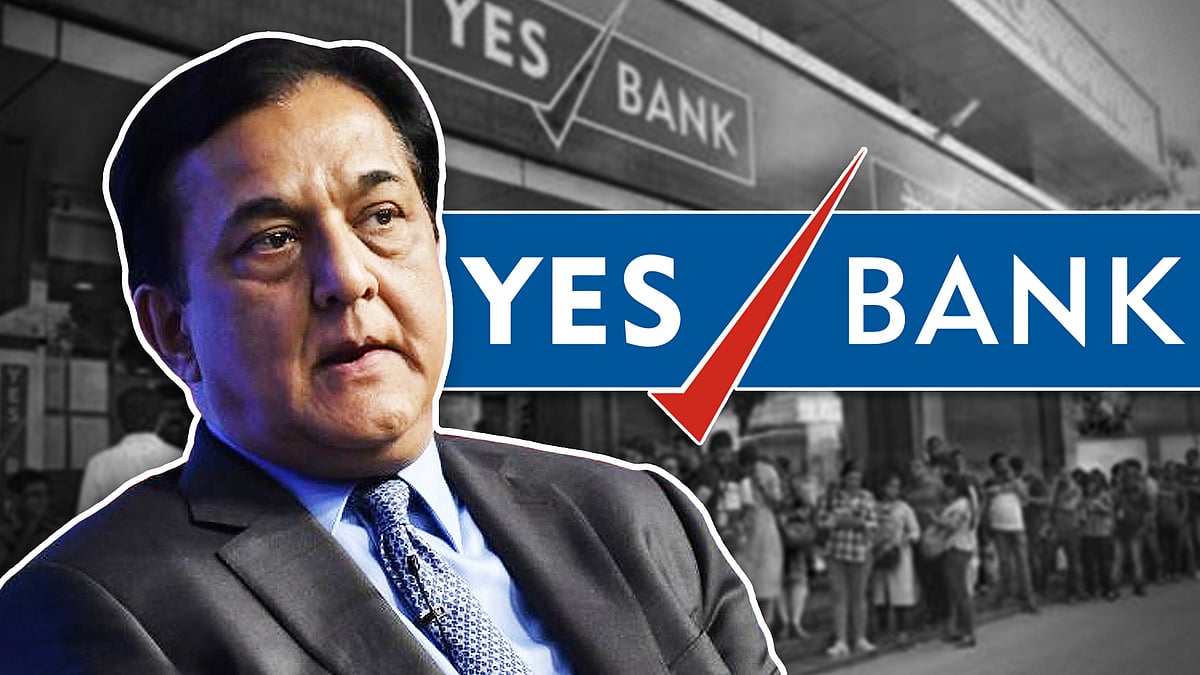

RBI brings out the bazooka to keep Yes Bank going. Will that be enough?

We need a comprehensive review of the Indian financial system, including not just banks but NBFCs as well.

Yesterday, Yes Bank came out of its moratorium.

The fear is that its depositors will line up at its branches and want to withdraw all the money that they have in the bank.

Any sustained bank run can bring down even the most well-functioning bank. The reason for this lies in the structure at the heart of any bank. In order to understand this, we need to go back a little into history and try and understand how paper money and banking came about.

The paper money the world uses as money these days is pure paper money. It has no real value of its own. It is fiat money. It is money because the government deems it to be money.

But that wasn’t always the case.

Throughout history, gold and silver and other metals were used as money (in the form of coins as well) across large parts of the world. Over the centuries, they were replaced by paper money and banks. An individual having gold deposited it into a bank and a paper receipt was issued against that deposit.

Over a period of time, these paper receipts started functioning as money. The merchant making the payment passed on this paper receipt to the merchant to whom the payment had to be made, because it was very convenient, instead of going to the bank, exchanging the paper receipt for gold/silver, and then making that payment.

The merchant receiving the paper receipt had the option of going to the bank and withdrawing the gold (or the silver) that had been deposited against that receipt. Or he could simply pass on the paper receipt to the next merchant to whom he had a payment due.

As Philip Coggan writes in More: The 10,000-Year Rise of the World Economy: “Gold and silver are clunky, and risky to carry around. The original function of banknotes was as a substitute for the hassle of carrying coins. They represented a claim on the gold and silver within the bank's vaults.”

As paper receipts — representing a claim on gold and silver in the form of coins or otherwise — started going from one merchant to another, paper money was born. Interestingly, this happened on its own in different parts of the world. First in China, then in continental Europe, and finally in Great Britain.

Gradually, the bankers realised that all the gold and silver deposited with them continued to stay with them and wasn’t withdrawn each day. As Coggan writes: “Since notes were so convenient, banks quickly found that most of the gold and silver they held stayed in the vaults. Only a small proportion was withdrawn each day. They could lend out this ‘spare’ money and earn a profit. This is the essence of ‘fractional reserve’ banking and thus the modern banking system.”

Of course, the risk with these banks was that a significant portion of the depositors could all turn up on the same day and demand their gold and silver back. If the bank had lent this money out, it would end up in trouble.

A modern bank is no different in that sense. As Coggan writes: “Fractional reserve banking is prone to crises. Banks have a natural mismatch. They owe money to depositors who can withdraw it any time, while on the other side of their balance sheets they lend money to individuals and businesses for long periods. If enough depositors want to withdraw their money at once, even a well-run bank will get into trouble.”

This is where it becomes important to explain the fallacy of composition. As Greg Ip writes in Foolproof: “ This fallacy occurs when what benefits an individual is wrongly assumed to benefit an entire group. For example, if one moviegoer stands, he can see the show better. But if everyone in the audience stands, no one sees better, and everyone is uncomfortable.”

Or to take another example here: Let’s say you go to watch a cricket match and are seated somewhere in the middle. Let’s say the person sitting in front of you gets up and stands to get a better view of the match. While he is getting a better view, it has inconvenienced you. So, you will also have to get up to get a better view. This will inconvenience the person sitting behind you and he will also have to get up to get a better view. This will continue, until the individual seated in the last row also gets up to get a better view.

A bank run is also a good example of a fallacy of composition. When an individual depositor has lost his or her faith in the bank, it makes sense for him or her to withdraw the deposits and move it to another bank. But this doesn’t make sense for the banking system as a whole.

As Coggan writes: “If depositors fear a bank will go bust, it makes sense for them to withdraw their money immediately. But this loss of confidence only makes the crisis worse.”

How does all this apply to what is currently happening in India?

Yes Bank and the Indian banking system are ready for a bank run. Business Standard reports that the Reserve Bank of India (RBI) has extended a credit line of a whopping Rs 60,000 crore to the bank. In that sense, the Indian central bank has drawn out the bazooka to tackle the crisis. This line of credit can be drawn on after Yes Bank has used its liquid assets to pay money to the depositors who are withdrawing.

The trouble is that the crisis won’t end with Yes Bank. The Yes Bank moratorium has led to a loss of trust which will impact more and more private banks. In fact, it already has. The IndusInd Bank, a bank slightly bigger than Yes Bank, has seen its deposits shrink “by nearly two percent as some state governments [have] shifted deposits” from the bank. Meanwhile, RBL Bank has seen its deposit base shrink by three percent.

Clearly, there is a lack of trust in these banks. Also, how bad the overall situation is for private banks in particular, and the banking system in general, will only get clear once the results for January to March 2020 are declared.

In this scenario, actions will speak louder than words. Other than reassuring the country that banks are safe, it is important that RBI fully vets the numbers of these banks and ensures that they aren’t doing a Yes Bank on the system. In fact, the only way to tackle this scenario is to carry out a second Asset Quality Review. This needs to be a comprehensive review of the Indian financial system, which includes not just banks but also NBFCs. The first Asset Quality Review was carried out in mid-2015.

As Arvind Subramanian and Josh Felman put it in a working paper titled India’s Great Slowdown: What Happened? What’s the Way Out?: “India must come clean on the entire financial system.”

What happens if the second round of the Asset Quality Review unearths more problems in the financial system? Well, it is better for the world to come to know of it through a proper review carried out by the RBI than suddenly one fine day, as has been the case with the troubles of IL&FS, Dewan Housing and now Yes Bank.

At Yes Bank, insiders moved on, outsiders got stuck

At Yes Bank, insiders moved on, outsiders got stuck  The six unseen effects of the Yes Bank fiasco

The six unseen effects of the Yes Bank fiasco