VCCircle: Two deals and a rollercoaster ride in between

Here's a classic case of how to ruin a growing media company.

In April 2017, when a four-member team led by Matt Goldberg, global head of mergers and acquisitions at News Corp, and Jonathan Wright, global managing director at Dow Jones, flew down to Delhi unscheduled, there was panic at VCCircle's office.

It was a rainy day in Delhi. Nita Kapoor, chief executive officer of the online financial news and data service provider, had reached Mayur Vihar's Star City Mall office before her usual time of 8 am. But she was suddenly unavailable for a crucial scheduled meeting at 9.30 am.

Soon, the word was out: the CEO had been sacked.

A niche news network with deal stories on venture capital and private equity firms, the Rupert Murdoch-owned News Corp, which took over VCCircle in 2015, was falling apart, in just about two years. News Corp was aghast at the fall in revenues and an outlandishly ballooning cost.

Sources say that ahead of its sale to News Corp, VCCircle’s founder PV Sahad, who carefully built the property over a decade, was under stress. In 2014-15, VCCircle faced a loss of Rs 5.4 crore over a revenue of Rs 13.2 crore. Over a dozen angel investors, who collectively held a little over 30 percent stake, were looking for an exit, and were not keen on another round of investment. Angels typically cash out in three or four years, especially in such VCCircle-like scenarios where the revenues are plateaued out. Here, some of them had stayed invested for over seven years.

Among the angels were Gopal Srinivasan (TVS Capital), Deepak Shahdadpuri (DSG Consumer Partners), and Gulu Mirchandani (Onida).

"Patience was running out with angels. Most of them had strayed, avoiding VCC events,” says someone in the know who devised strategies for the company. “They were not willing to invest further. There was a time when salary money was coming from sponsorship collections on a monthly basis.”

So, the message was loud and clear: “Sell.”

For Sahad, there were three offers on the table. Both HT Media and the Times Group were keen to buy his baby and integrate it with their business newspapers. Being the most conservative, HT Media suggested infusing funds to expand the equity.

But Sahad went with the third option, News Corp, for three reasons. "Slightly a higher valuation, quick deal-making and the banner of a multinational giant which was eager to make it big in India," says another who was very close to the deal.

On March 8, 2015, News Corp took over VCCircle for $3.12million, or Rs 20 crore (at Rs 63 per dollar at the time). The acquisition included VCCircle.com, its technology news portal Techcircle.in, data platform VCCEdge, VCCircle Training, and the most profitable conference business.

When contacted, Sahad refused to talk about the deal. "Some acquisitions work, some don't. I can't comment on what transpired at VCCircle," was all he said. The regret in his voice was unmissable.

Gopal Srinivasan, the chairman and managing director of TVS Capital Funds, who was the anchor investor in VCC, reminisces that it was the "best deal from the best buyer and the fastest deal making". For the man who wrote a cheque for VCCircle when he met Sahad for the first time at Delhi's Taj hotel, the aim was to make his industry more vibrant and connected with a credible platform like VCC.

"It was a logical journey,” he says. “After all, the river must merge into the ocean for us to find the strength of the universe and the oneness in it.”

A fair deal, where all employees who held around six percent stake were paid off handsomely. Sahad, who along with his family held a little over 60 percent, walked off with Rs 12 crore.

So, what went wrong with the acquisition?

For News Corp, which owns the Wall Street Journal, Dow Jones, Fox News and the Times, the fabled India story and its huge potential was a huge draw. As Robert Thomson, the CEO of News Corp, said at the time of acquisition, India was an increasingly meaningful part of their portfolio, which was itself increasingly digital and global.

Raju Narisetti, senior vice president of strategy at News Corp and the former editor of HT Media’s Mint newspaper, was given the mandate to buy a digital product. He quickly zeroed in on VCCircle, which was for sale. VCCircle was one of the first independent media platforms in the country to build a paid-subscription model. It had an established revenue model in place with its events and training departments. And the acquisition cost was a pittance for the global media giant.

Narisetti initially brought in an all-women CXO band. While Nita Kapoor joined as CEO, Neetu Singh came in as chief human resources officer. Archna Shukla came on board as chief editor when Sahad departed in March 2016, a year after the acquisition was sealed. Subsequently, the company brought in a chief technical officer, art director and chief revenue officer in an effort to professionalise the operations. "Narisetti wanted to build a Chinese wall between editorial and the revenue streams," said sources.

The team projected a Rs 60 crore target in three years: Rs 30 crore in the first year, Rs 45 crore in the second year, and Rs 60 crore in the third year. Almost everyone in VCC knew it was an impossible task.

The company went on a spending spree for new recruits and in-house training. It moved to a new office in Mayur Vihar, and its headcount went up to 150 in the first year from 75-80 during the acquisition. The indiscreet spending burnt a big hole in its kitty.

Narisetti's abrupt exit in September 2016 left the company in the lurch. Till such time Narisetti was around, he used to be hands-on. He would shuttle between New York and Delhi/Mumbai to attend all important VCC events. A sudden vacuum enveloped VCCircle.

The loss in 2016-17 went over three-fold to Rs 15.7 crore and revenues nosedived to Rs 11.9 crore. In the year that followed, losses moved up further to Rs 18.6 crore on Rs 9.5 crore revenue.

When approached with three pointed questions, Narisetti was kind enough to give me a long response, which loosely translates to "No comments". I reproduce it here:

"The questions suggest both a rather dated as well as a derivative hypothesis. They also reflect a fundamental misunderstanding of how and why business decisions occur at global organisations, in addition to any macro economic and regulatory factors that influence such decisions over time. While I could try and provide context, not only will it be a five-year-old, look-back lens, it would be quite inappropriate for me to talk about News Corp's management of its business units over the past five years, as I have not been privy to those decisions. I would strongly recommend you reach out to them directly, for all fact-checks and any additional comments they might consider making with regard to your questions."

A questionnaire sent to News Corp has not evoked any response so far.

As News Corp followed the July-June financial year, VCCircle offsites and brain-storming sessions were a regular affair during May-June every year.

At a formal offsite held at Heritage Village, Manesar, the CEO and the chief revenue officer “told” their four lieutenants — who head divisions of training, events, subscription and VCCEdge — to beef up revenues by manifold, by hook or by crook. The targets given to them were bizarre. Everyone gave a presentation, but with many asterisks. The CEO authoritatively cleared their presentations minus the asterisks.

The fall of InfraCircle

After seven- or eight-month-long trials, InfraCircle was launched on the sprawling lawns of the Imperial Hotel in New Delhi in a glittering ceremony, on December 15, 2016.

Nitin Gadkari, the minister for road transport, highways and shipping, was the chief guest, with the then railway minister Suresh Prabhu and steel minister Chaudhary Birender Singh joining him. Everyone thought the portal dedicated to infrastructure-related news had a flying start.

That was not to be.

At around 11.30 pm on December 31, as everyone was busy at New Year celebrations, InfraCircle team members got a curt message from their editor on their Telegram group: he had quit.

In the next three months, the news portal was blanked out. Its last story was uploaded on March 14, 2017. The homepage Infracircle.in promised its readers to come back with a product that is "richer and sharper".

But it never returned. All seven to eight journalists and a few support staff were laid off. They were told the project wasn't financially viable.

The Rs 60 crore target

The “Rs 60 crore in three years” target kept hanging, like the sword of Damocles.

In the second year (2016-17), revenues dropped to Rs 11.9 crore. After some experiments, the training division was shut down, literally killing the goose that once laid the golden egg. Techcircle.in was given a kind burial, merged into the main platform, and rechristened VCC Startups.

In the two years since the acquisition, News Corp figured out that VCCircle was going rudderless. Being top-heavy was making it bleed profusely. But the “target” probably acted as a carrot on a stick. A frugal startup before, where the founder used to be a one-man army — he was chief editor, CEO, CHRO, product head, and chief designer, all rolled into one — was teetering on the brink of a collapse under the weight of the high-salaried CXO brigade.

After the CEO was sacked, Matt and Jonathan quickly called a meeting of all other seniors. Eight of them joined. A simple question was put forth: Did anyone in the team believe the CEO's Rs 60 crore revenue target for 2018-19? The answer was a unanimous and resounding “no”. Soon, every department target was sliced down to achievable levels.

But that didn't bring any respite. Bad news continued to pour in.

The old CRO was sacked, a new one was brought in. He fired some existing staff, juggled some others between departments. Things came to a knot when he faced a sexual harassment case, and was eased out in March 2017. Another sexual harassment case came up and dragged down a few seniors in the Delhi office for over a year, just before the #MeToo campaign took the media by storm.

A big hunt was launched for the new CEO. Jaideep Mehta, former managing director (India) of IDC, a research firm, came on board after a six-month long search and several rounds of interviews. He brought in a new chief business officer from IDC. Sources say that the office became extremely unfriendly; howls and insults were the order of the day.

Mehta reintroduced Techcircle.in as a separate site, seven or eight months after it was merged with the main platform. He tried to turn a venture capital and private equity news company into a technology company, hoping to draw strength from his experience. A senior editorial person said his idea was to turn TechCircle into a flagship brand. But the much-publicised TechCircle Live event held at Taj hotel, Bengaluru, on May 3, 2018, failed to bring any revenue.

In VCCircle's roller-coaster ride, the editorial department however remained an island of calm. A good bunch of experienced journalists with domain knowledge kept breaking deal stories. It was in direct competition with pink newspapers and foreign wire agencies. But VCCircle had an edge over the rivals, thanks to its proximity to venture capital and private equity players.

The Chinese wall that Narisetti had proposed to build, however, collapsed much before the foundation stone was laid. CXOs regularly interfered in editorial matters and pushed their “revenue” agenda. Unsurprisingly, subscription numbers fell below 3,000 from a peak of 5,000.

Nepotism by CXOs, extravaganzas (with offsites and training), indiscreet spending (with office changing thrice, first to Noida Sector 2, then Mayur Vihar, and then to Okhla), office politics, and the sexual harassment cases dragged the organisation to the point of no return. VCCircle generated at least one complaint a day to make it nauseating for News Corp bosses sitting elsewhere in the world, say sources. Several careers were ruined in the process.

Yet, News Corp continued to infuse funds into this tiny black hole. To be precise, Rs 68.9 crore over four years till June 2019, over and above the deal value. As losses mounted, it brought in Rs 22 crore in February 2017, Rs 25.3 crore in March 2018, and Rs 8.8 crore in June 2019. This year's infusion could not be accessed.

Sources say that Matter, a Mumbai-based advisory firm, was roped in to find a buyer in 2018. It held parleys with two leading newspaper groups in Mumbai and a private equity player. In the end, HT Media, which wanted to buy VCC in 2015, finally wrapped it up five years later for one-third of the price.

Many believe the government move in August 2019 to restrict foreign direct investment for digital media companies that upload or stream news to 26 percent would have driven the final nail in VCCircle’s coffin. A former team leader said a media giant like News Corp wouldn't want to work with an Indian partner, that too holding a minority stake in the venture. But the fact is that News Corp had begun a search for a buyer at least two years ago.

What is evident is that the valuations of Indian online news properties have collapsed after the government shut the door on foreign media.

Exit, finally!

When the deal was announced, it sent shock waves to the topbrass at VCCircle. The deal is nothing but a frantic distress sale. HT Media, which laid off several journalists over the last three months, said in a communique that it would "unlock cost and revenue synergies" through the acquisition.

In a carefully worded regulatory filing, it said the board accorded approval to invest up to Rs 6 crore post working capital adjustment, and revenue-linked milestones payment up to Rs 1 crore on deferred basis, to acquire 100 percent equity. It also plans to scale VCCircle and TechCircle to augment the content and editorial capabilities with reference to Mint’s tech and deals coverage. It will also use Hindustan Times’ reach to augment VCCircle’s events business and scale up the database and research business.

It expects to complete the acquisition before August 30.

Update: PV Sahad's quote has been updated.

***

The coronavirus crisis has shown how precarious the media model that runs on ads is. It's essential for the media to be powered by paying readers and viewers to be free and independent. For when the public pays, the public is served and when the advertiser pays, the advertiser is served. Pay to keep news free by subscribing to Newslaundry today.

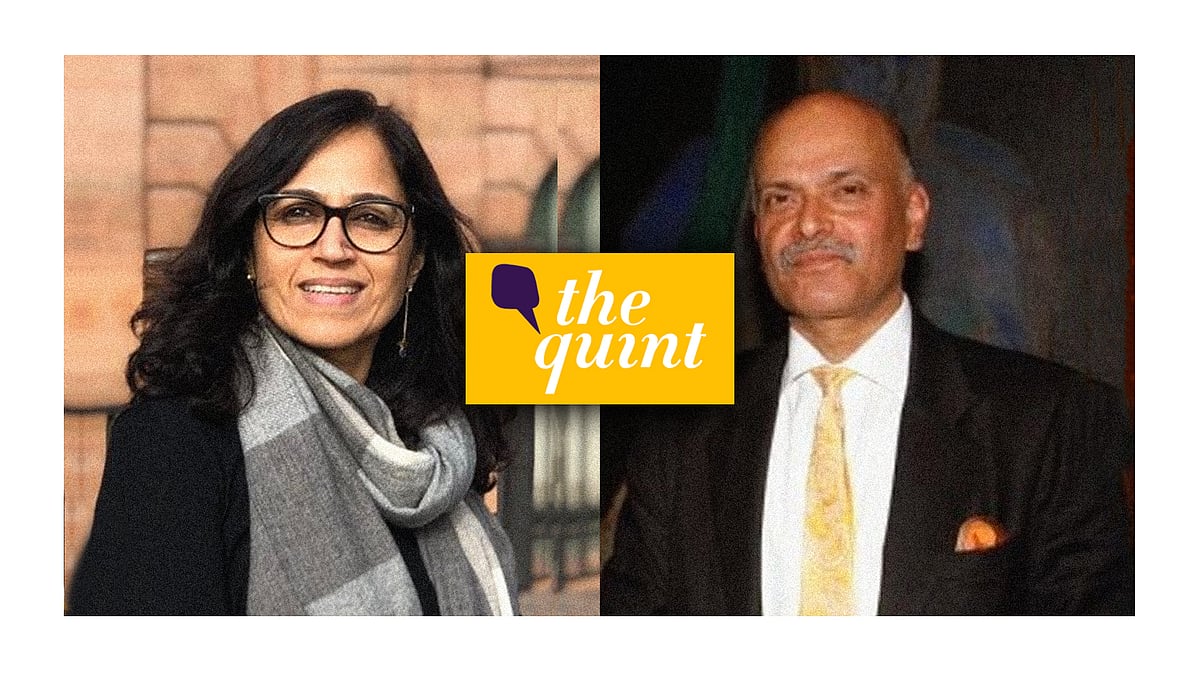

What is Raghav Bahl's game plan with the Quint's unusual sale and purchase?

What is Raghav Bahl's game plan with the Quint's unusual sale and purchase?