Competition watchdog may get in the way of proposed Zee-Sony merger

The Competition Commission of India has sent a notice to the TV networks noting the proposed merger could give them 'unparalleled bargaining power', Reuters reports.

The Competition Commission of India has sent a notice to Sony and Zee networks over the possibility of their proposed India merger hurting competition through “unparalleled bargaining power”, according to a Reuters report.

In a 21-page notice, the watchdog said the proposed deal would place the combined entity in a "strong position" with around 92 channels in India. “Such apparently humongous market position would enable the combined entity to enjoy an unparalleled bargaining power," the CCI observed, adding the networks could increase the price of channel packages.

Noting that its initial review merits further investigation, the commission gave the two companies 30 days from August 3 to respond.

The Indian unit of Japan’s Sony and Zee Entertainment had in December decided to merge their media assets to create a powerhouse in a key media and entertainment growth market.

The CCI's findings will delay regulatory approval of the deal and could force the companies to propose changes to its structure, three Indian lawyers familiar with the process told Reuters. If the CCI is not satisfied with the response, the approval and probe may be delayed further, they said.

Zee said it continues to take all the required legal steps to complete all the necessary approval processes. The CCI and Sony in India did not immediately respond to requests for comment. Representatives of Sony in Japan did not respond outside regular business hours, according to Reuters.

Sony and Zee had already responded in June and July to other letters issued by the watchdog.

After analysing submissions related to advertising revenue, the CCI said the merged entity was likely to use its strong market position to increase the price of some advertisements.

"The combined strength of the parties is likely to be used to entrench their presence and earn higher profits," the CCI said. "This merger is a classic case of the first or second largest player, integrating with the third largest competitors, to become the strong market leader."

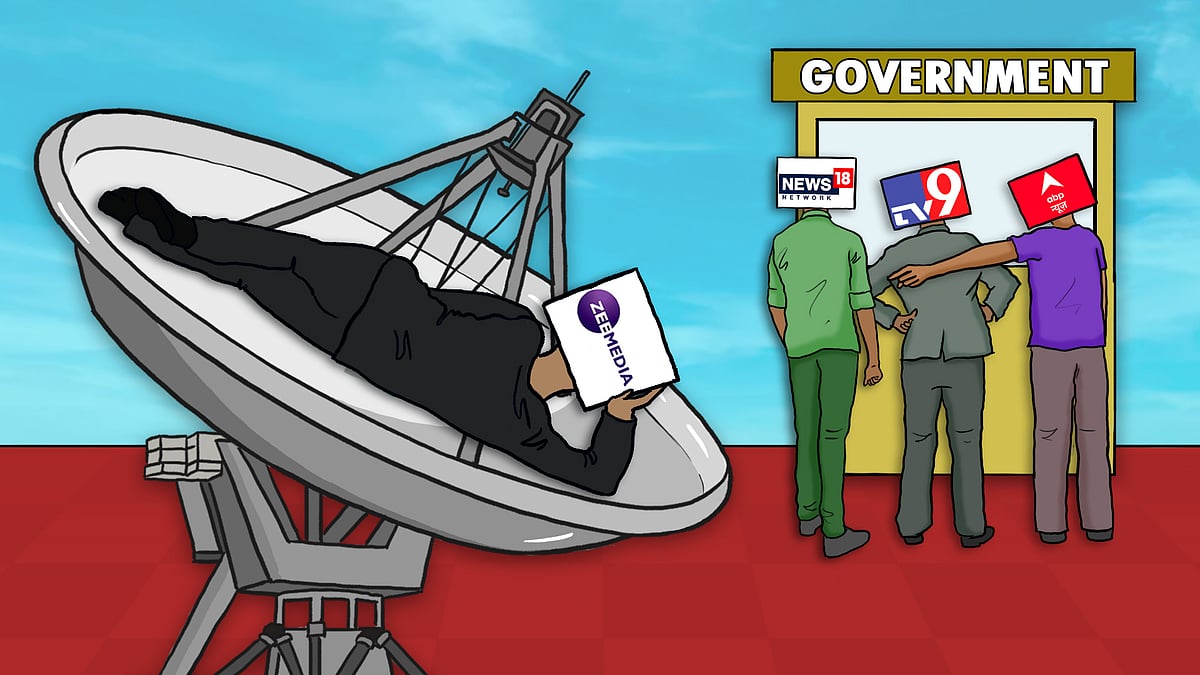

Why news channels have approached the government against Zee

Why news channels have approached the government against Zee