2023 could have been the year that wrecked Adani. Did it?

He took a hit from the Hindenburg report, but might be happy with how he ends the year.

There was one question on everyone’s mind the first month of this year: Will the Adani Group be able to weather the Hindenburg storm?

Editorials were written, numbers analysed, and stocks weighed. And for good reason too, after Hindenburg Research, a US-based short-seller, published a damning report in January accusing the group of “brazen stock manipulation and accounting fraud” and pulling the “largest con in corporate history”.

Did Gautam Adani escape unscathed? Hardly. He’s still dealing with some of the consequences. Among the 500 richest people in the world, his net worth sank the most – by over $60 billion within just 10 days of the report emerging. He also faced the biggest one-day loss of any billionaire, shedding $20.8 billion on January 27.

But as the year draws to a close, how deep do these scars run? Has Gautam Adani bounced back?

The answer is both yes and no.

Acquisitions after a 7-month pause

The Hindenburg report did put a brake on acquisitions by the Adani Group. Shortly before the report came out, Adani managed to wind up a deal five years in the making – the purchase of Haifa port in northern Israel for $1.15 billion.

The group’s first major acquisition after the Hindenburg fiasco came seven months later in August, when Adani’s Ambuja Cements bought cement company Sanghi Industries in a $600 million deal.

In November, Adani’s Colombo port terminal project received $553 million in financing from the US International Development Finance Corporation. When asked about the Hindenburg report, the corporation’s CEO said: “I don’t think Adani Ports, the subsidiary, was implicated in any of the allegations you mention.”

The US federal government’s Development Finance Corporation had conducted and concluded a due diligence investigation into the Adani Group. Additionally, in June, the US Attorney’s office had sent inquiries to investors with large holdings in the Adani Group while the US Securities and Exchange Commission also announced a probe into the Hindenburg allegations. It’s unclear whether these investigations have wrapped up.

December was a busy month as the Adani Group closed deals and started partnerships to end the year on a higher note than when it began. Adani Green Energy finalised a 25-year power purchase agreement with the Solar Energy Corporation of India. Adani Energy Solutions acquired a 49 percent stake in the smart metering arm of the UAE-based Eyasoft Holdings to form a joint venture.

And while the Supreme Court reserved its judgement in the Adani-Hindenburg case in November, the court remarked that media reports should not be treated as “gospel truth” and that the Hindenburg report could not be considered “credible”. In response, the shares of Adani Enterprises went up by nine percent and of Adani Total Gas by 20 percent in a single day.

The year ended with the Adani Group exploring an investment of $10 billion in Vietnam over the next decade, further solidifying plans by meeting with Vietnam’s Prime Minister Pham Minh Chinh.

Overall, Gauti Adani raised $8-10 billion this year through stake sales in group companies, The Hindu Businessline reported. He spent $6-7 billion to consolidate stake in the companies.

The fall

Between January 24 and February 22, Gautam Adani’s net worth fell from a whopping $120 billion to $46.1 billion. Eleven months later, his net worth stands at $72 billion. He started the year as the world’s third richest person but is now just the sixteenth.

Adani’s companies lost $110 billion in value in the two weeks following the Hindenburg revelations. Bloomberg estimated that the “severity, scale and speed of Adani’s plunge” was unlike anything the world had seen before.

In February, Adani Enterprises abandoned – a move termed as “abrupt” – a $2.5 billion deal to sell shares, just 24 hours after it was sealed.

In August, fresh accusations against the Adani Group emerged through a report by Organised Crime and Corruption Reporting Project, which said that the group used “opaque investments” through Mauritius. While these accusations too were denied by the tycoon, Adani Group’s shares slipped into the red territory as a consequence.

Four companies of the Adani Group are among the worst 10 performers on the S&P BSE 200 Index this year, Bloomberg reported. The flagship company of the group, Adani Enterprises, is yet to recover from the blow and is down more than 25 percent.

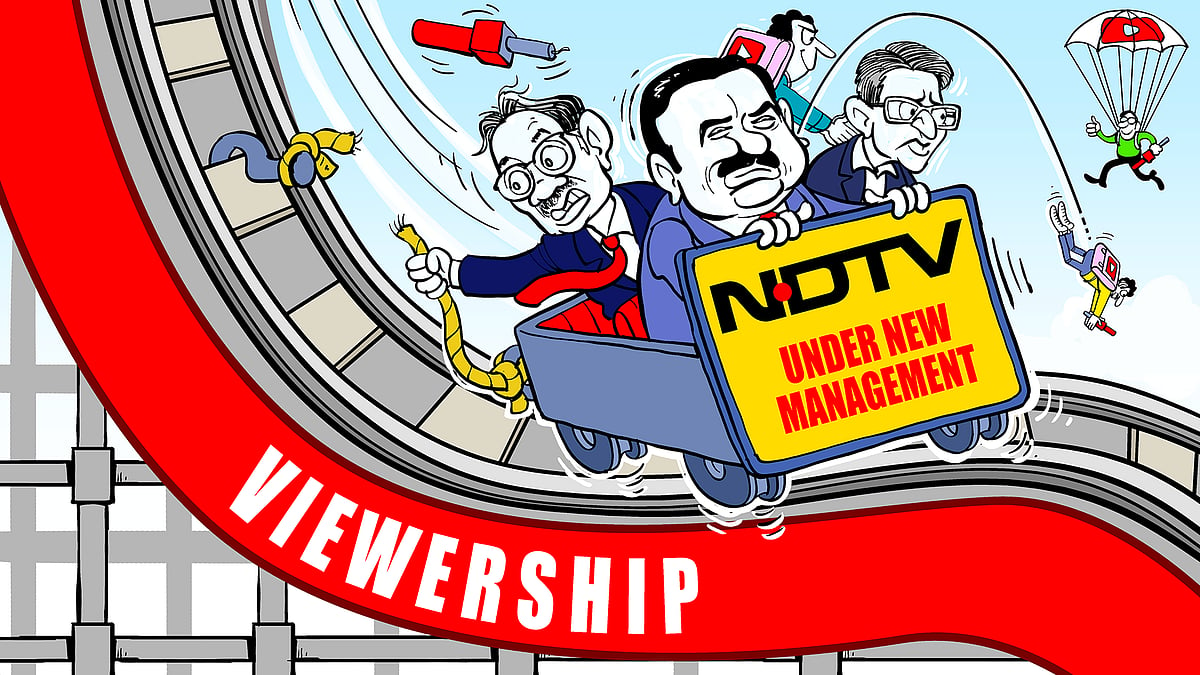

Growing media presence

From media appearances to media acquisitions, Gautam Adani made significant progress in the media world this year. After a landmark takeover of NDTV last year, Adani’s media wing, AMG Media Networks, acquired a majority stake in newswire agency IANS in December. Eyebrows were raised at how the group managed to acquire 50.5 percent of the company for just Rs 5.1 lakh, but that’s a story for another day.

This month, Adani also relaunched NDTV Profit in an “all-new avatar” combining it with BQ Prime. The group also acquired the remaining one percent stake in Quintillion Business Media in August, taking full control in the firm that operates BQ Prime.

This diversification into media means that the tycoon’s grip over the media is getting stronger. After an hour-long interview with India Today last December, Gautam Adani also gave a 90-minute interview to India TV this January, in a mock courtroom setting. Among other hard-hitting questions, anchor Rajat Sharma asked him if he had enjoyed earning money as a child.

During the same interview – promoting aggressively on India TV’s rival and Adani’s new acquisition NDTV – the billionaire dismissed allegations of receiving preferential treatment from Prime Minister Modi. He said his group’s work spanned 22 states, including those governed by the opposition, and one couldn’t get “personal” help from Modi. He also addressed Rahul Gandhi’s allegations against him of crony capitalism, saying it was just “part of the business of politics”.

It was a continuation of the vibe of his December 2022 interview to India Today, where Adani was presented as a humble, self-made man who was hyper-focused on not only the growth of his companies but the growth of the nation.

Not much changed when the Hindenburg report came out, at least on a section of news channels. NDTV, News18, Aaj Tak, Times Now and Republic rushed to Adani’s defence, presenting the report as an attack on India.

But what the report did do was push the opposition to relentlessly question Modi’s closeless to Adani. Months later, when Trinamool Congress MP Mahua Moitra was accused of taking bribes to ask questions on the Adani Group in Parliament, the group reacted with vindication. It said the charges revealed how “groups and individuals have been working overtime to harm our name, goodwill and market standing”.

While the investigations by Indian and foreign authorities and courts are yet to be concluded, as the year ends, Adani has not been formally charged with anything yet. With an important election in India just a few months away, it remains to be seen what 2024 will hold for India’s second-richest person.

If you’re reading this story, you’re not seeing a single advertisement. That’s because Newslaundry powers ad-free journalism that’s truly in public interest. Support our work and subscribe today.

Adani or algorithm? NDTV’s digital views continue to shrink

Adani or algorithm? NDTV’s digital views continue to shrink