Budget 2024: Why cash to people and not corporates will boost consumption

The union budget needs to look at the slowdown in consumption growth as the country’s most pressing problem.

Indian capitalism started in the textile mills of Mumbai – which were built in areas such as Byculla, Worli, Prabhadevi, Lower Parel, Parel, and Dadar – all located in what is now known as central Mumbai.

Over the years, these mills have ceased to function and have been gradually demolished and replaced by high rises, which almost touch the sky. In these high rises work many individuals who are in the business of managing other people’s money (OPM) or in the business of making money from OPM.

When they look out of these high rises, Mumbai seems very beautiful in long shots, especially when it’s raining, like it is these days.

The city seems washed and clean. From a distance, the local trains going up and down on the railway tracks bordering many of these buildings, seem almost like toy trains. The Bandra-Worli sea link – the structure used to sell space in many such buildings – showcases all the development that has happened and that is still happening in Mumbai. From up there, Mumbai looks like any other international city, with its spirit alive, thriving, and kicking.

It’s only when you step out of these buildings and open your umbrella to walk through the rains – with broken roads and puddles of water everywhere, with the walking footpaths having been taken over by small entrepreneurs selling everything from umbrellas to gajras to mobile phone covers to fruits and vegetables, with people hurrying to make their way to the nearest local railway station almost touching you if not pushing, and where they will first be forced into the bogeys and then packed in like sardines, or other people, the slightly better lot, waiting for taxis which they are not able to find, and if they are able to find one, the drivers don’t want to drive to their side of town given that it will take them a few hours to get there, with a very high chance of getting stuck in bumper-to-bumper traffic that follows any dash of rains – do you realise that Mumbai looks very beautiful only in longshot.

Of course, the OPM wallahs don’t step out of their building on foot. They go out in their fancy cars with tinted glasses and the AC on. They don’t walk in Mumbai. They don’t smell it. They don’t feel its humidity, and given that they are usually driving towards the southern part of the city and not its suburbs, they don’t face its traffic either.

In their heads, the BSE Sensex, India’s most popular stock market index, is ready to cross 1,00,000 points in 2025, 1,60,000 points by 2029, and 10,00,000 by 2047. The stock market is doing well, so the Indian economy is doing well – it’s what they will tell you if you ever happen to ask them – kya lagta hai?

Even on the ground, they see things only in long shots because it’s beautiful to see things in long shots. Indeed, the devil, as always, is in the details, but why let that detail spoil a good story?

The Indian economy is currently in a similar position. It looks very beautiful in a long shot. But there are problems, and major ones. In 2023–24, the gross domestic product, a measure of the size of an economy, grew by a very good 8.2 percent in real terms, adjusted for inflation.

In comparison, the private consumption expenditure, the money you and I spend on buying goods and services, grew by just 4 percent, the slowest since 2002–03, if we ignore the pandemic year of 2020–21, when it had contracted.

Now, this should be worrying as private consumption forms 55–60 percent of the Indian economy. This slowdown in private consumption growth is now visible in corporate financial results as well. In 2023–24, the net sales of more than 3,900 non-finance firms listed on the stock market grew by just a little over 1 percent, after having grown 34.9 percent and 22.6 percent in 2021–22 and 2022–23, respectively.

More specifically, this slowdown can be seen in a whole host of other more focused data as well – focused data and not theoretical constructs either made in Delhi or made on Delhi’s orders – and then picked up by the OPM wallahs sitting in their high rises admiring the Bandra-Worli sealink.

Domestic two-wheeler sales are nowhere near the peak of 21.2 million units achieved in 2018-19. This in a country where two wheelers are a very important aspirational acquisition. Clearly, people are being less aspirational.

Or take the case of non-suburban railway travel. It peaked at 3.94 billion passengers in 2012-13 and was at 2.99 billion in 2023-24. Or take the case of teledensity, which peaked in 2016-17.

More recently, the growth in the collections of goods and services tax (GST) has been rather subdued. In May 2024, GST collections grew by 9.96 percent – the first time this growth has fallen below 10 percent since June 2021. In June, the growth slowed down further to around 7.8 percent. The finance ministry has now stopped sharing detailed data on GST collections.

What all this tells us is that a large section of the population is having trouble on the consumption front. A major reason for it is high inflation. As a report on Livemint pointed out, “Indian households spent 18 percent more in the March quarter of 2024 than in the June quarter of 2022, on account of rising inflation, market research firm Kantar said in a note.” Further, Pranjul Bhandari, chief India economist at HSBC Securities and Capital Markets, recently said that India’s inflation is also K-shaped, with inflation in urban areas falling and inflation in rural areas remaining high and sticky.

This can be clearly seen in the inflation figures. Urban inflation in 2020–21 stood at 6.5 percent, whereas rural inflation was 5.9 percent. In 2023–24, urban inflation was at 5.1 percent, whereas rural inflation was at 5.6 percent. Clearly, urban inflation has fallen more, whereas rural inflation hasn’t fallen at the same pace and, hence, is sticky.

Given this, the union budget, which is due on July 23, needs to look at the slowdown in consumption growth as the country’s most pressing problem. The need of the hour is to put more money in the hands of people. How can that be done?

First, the taxes earned by the union government on the sale of petrol and diesel need to be cut. While this may not add up to much at an individual level, at an aggregate level, it does. It might also help in controlling inflation.

Second, the goods and services (GST) tax on two-wheelers needs to be brought down from 28 percent to 18 percent. While this is something that the union government will have to discuss with the states, the ball can be set rolling through an announcement in the budget speech. Higher two-wheeler sales will have a multiplier effect on everything that goes into the making of a two-wheeler – from rubber to plastic to steel.

Third, the government should make a clear allocation to the Mahatma Gandhi National Rural Employment Guarantee Scheme – the country’s work guarantee scheme – and not dilly-dally on that front. The work demanded under the scheme remains high, and the government needs to fulfil this demand.

Fourth, as a report in the Deccan Herald pointed out, the government, in a bid to boost consumption, is thinking about a cash transfer scheme for poor urban women. This is a good idea. It makes more sense to put money in the hands of the aam aurats than in the hands of corporations through ways like the corporate income tax cut that was carried out in September 2019 or schemes like the Productive Linked Incentive (PLI) scheme, which has been promoted hard in the recent years.

These moves will work towards boosting private consumption growth in the short term, and only once that happens will corporates invest more in the Indian economy, which in turn will create jobs and feed consumption growth further. Indeed, the time has come to look at the details of the Indian economy and not keep looking at it and talking about it only in the long shot. The devil is in the details, and the economy is not just about the Sensex going up.

Vivek Kaul is the author of Bad Money.

Small teams can do great things. All it takes is a subscription. Subscribe now and power Newslaundry’s work.

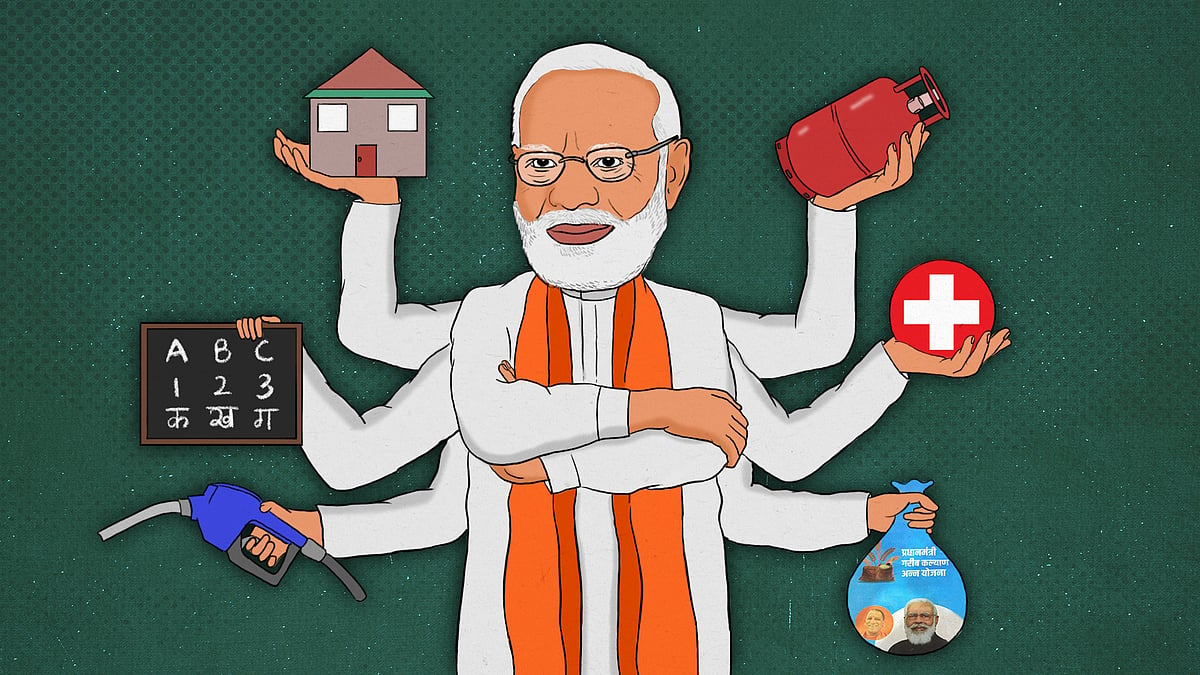

The big picture of Modi’s welfare state: Same budget, new schemes, more coverage, but education hit

The big picture of Modi’s welfare state: Same budget, new schemes, more coverage, but education hit